Individual InvestorsCreate a better version of daily life by going beyond the wishes of our customers.

Seven Bank’s Operating System

Seven Bank provides a unique financial service that is close, convenient, reliable, and safe. Our domestic network of 26,000 ATMs can be found at Seven & i Group stores, including 7-Eleven, as well as shopping centers, tourist destinations, airports, and stations, to meet the diverse needs of our many customers. We make use of DX to provide unique financial services. For individual customers, we offer convenient account services that support their daily lives. For corporate customers, we offer secure and convenient services that take advantage of Seven Bank’s strengths, including ATMs. At the same time, we are leveraging our ATM operating know-how to expand ATM services in the United States, Indonesia, and the Philippines.

Domestic business

ATM platform strategy

Retail strategy

Corporate strategy

- Consolidated subsidiaries

- Bank Business Factory Co., Ltd

- Seven Payment Services, Ltd.

- Seven Global Remit, Ltd.

- ACSiON, Ltd

- Credd Finance, Ltd.

- VIVA VIDA MEDICAL LIFE CO., LTD

Overseas business

Global strategy

- Consolidated subsidiaries

- FCTI, Inc.

- PT. ABADI TAMBAH MULIA INTERNASIONAL

- Pito AxM Platform, Inc

Unique Business Model

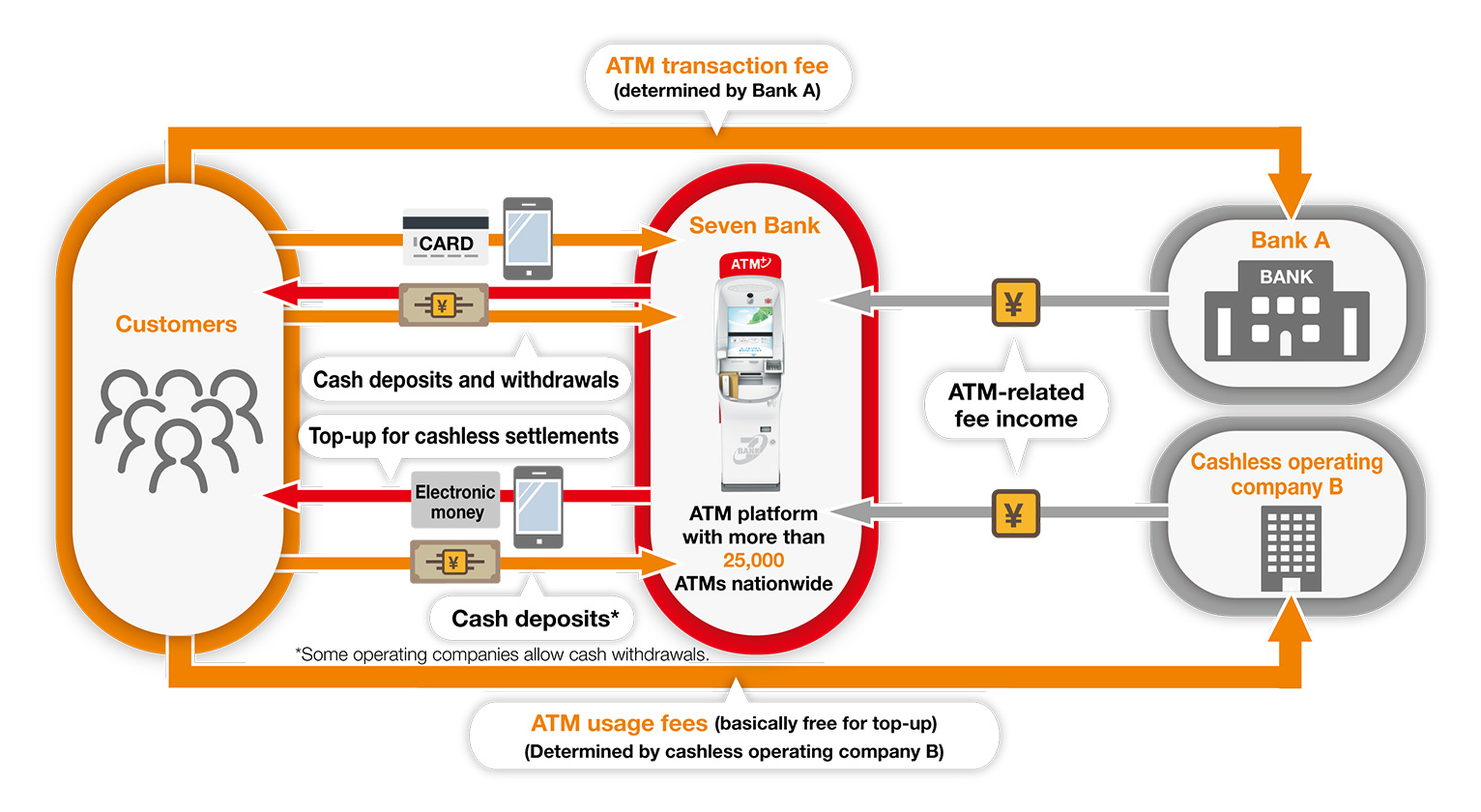

A Unique Business Model Founded on Coexistence and Co-Prosperity

Seven Bank provides ATM services that can be accessed “anytime, anywhere, by anyone, and with safety and security” throughout Japan. Our services also benefit our

partner financial institutions, etc., in various ways in terms of cost and enhanced services.

Seven Bank and its partner financial institutions, etc., have built a unique business model founded on coexistence and co-prosperity.

Business Model for Our ATM Services (in a partnership with a bank)

Coexistence and co-prosperity partners

Our core business is to provide customers and affiliated financial institutions with convenient and benefits through Seven Bank ATMs.

We will strive to form partnerships with all financial institutions so that customers can use any of their cards.

Superiority in Our Business Environment

| Banks | 123 |

|---|---|

| Shinkin banks | 252 |

| Credit cooperatives | 124 |

| Labor banks | 13 |

| JA Bank | 1 category |

| JF Marine Bank | 1 category |

| Shoko Chukin Bank | 1 |

| Securities companies | 8 |

| Life insurance companies | 6 |

| Other financial institutions | 91 |

| Over | 620 |

※JA Bank and JF Marine Bank are each counted as 1 institution.

Enhancing the Corporate Value

Seven Bank’s Competitive Advantage and Management Resources

Since its founding, Seven Bank has always stood in its customers shoes and continued to take on various challenges. Seven Bank’s ATM services that can be used anytime, anywhere, by anyone, and with safety and security now serve as social infrastructure that meets diverse needs. They are supported by the following strengths.

-

Nationwide ATM network

We have ATMs at Seven & i Group stores, including 7-Eleven, as well as airports,

stations, commercial facilities, and tourist locations to meet diverse needs of our many customers in their daily lives. In addition to traditional cash deposit and withdrawal transactions, usage of our ATMs has continued to grow as a valuable point of contact between the real and virtual world amid the trend toward cashless settlement, including topup transactions to support diversifying settlement needs.

This ATM network, which has grown to serve as social infrastructure, is the core of our business and our unique strength.ATM as social infrastructure

- More than 26,000 ATMs throughout Japan

- Alliance Network of 620 companies

- Used by some 2.5 million customers a day

-

Realization of The Non-Stop 24/365 ATM

Seven Bank develops its ATMs jointly with its partner companies. Our ATMs, always developed from the customers’ point of view and manufactured to the highest level of quality, are operating continuously, 24 hours a day, 365 day a year.

In the event of any problems, we quickly restore service with partner companies. Responding to ATM outages, providing ATM security, and securing transport require collaboration with partner companies with highly specialized skills.

ATM Call Centers monitor our ATMs 24 hours a day, 365 days a year, and our ATMs are able to achieve a 99.98% operating rate.Relationship of Trust with Partner Companies

- Development capabilities to achieve high quality and multifunctionality

- Ability to perform thorough security and maintenance work

- Unparalleled system operation capabilities

-

As a member of the Seven & i Group

Roughly 22.2 million customers visit Seven & i Group stores every day (fiscal year ended February 28, 2022). We utilize this Group’s customer base to develop and provide unique financial products and services for the convenience of our customers. We work on to provide new customer experience values that seamlessly connect shopping and finance,

going beyond conventional thinking, while constantly being aware of the customers’ point of view and new challenges. Toward demonstrating further group synergies,

we strengthen collaboration with the Group companies to create new values that connect us with our customers in their daily lives.Demonstrating Group synergies

- Seven & i Group’s customer base Brand strength that drives

- the ability to attract customers

- Formidable presence

-

Integration of expertise unique to a bank and advanced DX

The development of the digital society also drastically changes the business model of finance. In addition to ATM services we have developed, we combine advanced DX with our expertise and know-how we have cultivated to date such as banking back-office support and systems, authentication and security, and cash settlement functions, to create new business. Seven Bank’s ATMs serve as a service platform that enables collaboration with administrative and medical services,

such as an Individual Number Card and a health insurance card. Leveraging such infrastructure, we aim to meet diverse customers’ needs, develop ways of using ATMs suitable for the present time, and further expand our social values.Establishing service platform

- Highly reliable back-office processing capabilities

- Safe and secure fund management and fund transfer

- Cutting-edge authentication technology

- Advanced security functions

ATMs installed nationwide

Our core business is to provide customers and affiliated financial institutions with convenient and benefits through Seven Bank ATMs.

We will strive to form partnerships with all financial institutions so that customers can use any of their cards.

Value Creation Process

In order for Seven Bank to achieve sustainable growth, it is essential to enhance both social and economic value by leveraging our strengths and solving social

issues through our core business.

Aiming to fulfill our Purpose, we work to establish a foundation for the second stage of growth as well as to build a management foundation that supports long-term

growth, for enhancement of our corporate value.

Seven Bank’s Long-Term Vision

People’s lifestyles and financial needs change with the times. Seven Bank recognizes that these changes are an opportunity, and together with our diverse stakeholders, including our customers and partner financial institutions, aims to realize a better society and sound business development.

Seven Bank in terms of numbers

Number of ATM transactions per Fiscal Year

The operational rate of our ATMs